Archival Reflections—Insights from the Vast and Rich Resources at the Barings Archives

Letter from Nicolas Bouwer, Baring's agent in Argentina to Barings dated 14th December, 1876. Reference: HC4/1/65/1 (Baring)

By Tehreem Husain (University College London)

“I may however mention that from what I learn both Treasuries are in want of funds for the several works that are in progress. A part of the drainage works have been finished but in order to complete them thoroughly and to extend them over the whole area of the town a good round sum will be required.” (Source: (1876). Letters from Nicolas Bouwer to Barings, HC4.1.65.1)

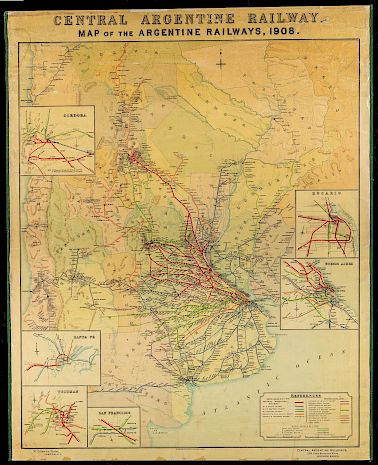

The House of Barings was established in 1762 and started out by trading on its own account, and on joint account with other merchants, buying and selling commodities and other goods in British and overseas markets. They also acted as London agents for overseas merchants, arranging shipping and insurance, making and collecting payments. Over time, Barings reduced their stakes in commodity trading due to its speculative and risky nature, and heavily ventured into the work of issuing securities for governments and businesses, especially railway companies. Barings also acted as paying agents, being particularly associated with Argentine, United States, Canadian and Russian governments.

The House of Barings were amongst many financial intermediaries heavily involved in underwriting sovereign securities. By the end of nineteenth century, underwriters had an established market in sovereign securities, but their participation was even more critical to the success of quasi-sovereign railway securities. This is due to the characteristic nature of railway projects (e.g. capital intensity, asset-specificity, high upfront investment, enormous sunk costs and long breakeven time) that made underwriter’s role pivotal in developing markets for railway securities (Kasper, 2015; Sawant, 2010; Helm, 2010). Underwriters such as the House of Barings played a crucial role in railway financing, acting as 'match-makers' between borrowers, investors and third parties like government. This is also reflected in the extract cited at the beginning of this article, a letter by Nicolas Bouwer, Baring’s agent posted in Argentina from 1876-1890. The letter exhibits Bouwer urging the House of Barings to invest in public works to complete the Argentinian drainage works project thoroughly.

Correspondences such as that between Nicolas Bouwer and Barings, are categorised under the archives ‘House Correspondence Series’, which amongst others, form an important part of the Barings archives, one of the finest financial archives globally. The ‘House Correspondence Series’ are arranged by country of origin and form a crucial part of its nineteenth century archives. Letters received from the firm’s agents and mercantile clients in North America, Europe, India, Latin America and Russia comprise much of the holdings, as correspondence with agents lie at the heart of the organisation’s information system. This information flow enabled Barings to have valuable information on the macroeconomic environment and political situation helping them to anticipate market movements and analyse risk (Orbell, 2000). Additionally, the correspondences exhibit the development of personal ties between agents, statesmen, bankers and entrepreneurs that helped actors in global financial centres such as London and Paris to overcome problems of commitment and foster cooperation (Vedoveli, 2018). Yet, the correspondences are still only part of the large collection of Barings Archives weaving a history of its vast global business operations.

Overall, the archives are meticulously organised and preserved and constitute a valuable resource in understanding the global history of financial capitalism, particularly for the study of international capital markets and world trade. Scholars of financial history will also find the Statistics of General Trade, a vital resource in constructing a dataset on global trade with detailed description of volumes and prices of various commodities at different international locations. Related to this are papers relating to the management of the firm’s sailing ships from the 1860s to the 1880s, and their participation in the China tea trade. The resource gives rich insights into the mechanism of this global trade and the costs and profits associated with the operation of sailing ships.

Recently, Baring Archive’s inaugural academic workshop titled ‘Agents, Intermediaries and Networks: Revelations from the Baring Archive’ was held on Nov 3, 2022 highlighting different aspects of the Baring Archive and their importance for understanding the global history of financial capitalism. The workshop commenced with a welcome from Clara Harrow, Archivist at the Baring followed by Dr. Rowena Olegario, Co-Director of the Global History of Capitalism project and Trustee of the Baring Archive, who elaborated on the theme of the workshop and the resources available in the archive.

The workshop comprised of three insightful presentations by academics using various areas of the Baring Archive for their research. First was Professor Larry Neal, Professor Emeritus of Economics at University of Illinois at Urbana Champaign who delivered a highly interesting presentation titled ‘The Baring Archive: Its Value for the History of Financial Capitalism’. Neal discussed insights from exploring Sir Francis Baring’s papers titled the ‘Northbrook Business Papers’ to help understand the process by which London became the global financial centre during the late eighteenth and early nineteenth century.

Second, Dr. Emily Buchnea, presented ‘Global connectedness and contextual richness: The Value of Long-Run Historical Social Network Analysis’ having used the Latin American correspondence for her research. She argued that the use of historical Social Network Analysis provides rich insights into understanding contextual, longitudinal, multilevel and processual explanations of international business (Buchnea & Elsahn, 2022). Last, Dr. David K Thompson delivered a presentation titled ‘Barings, American State Debt, and Slavery in the Nineteenth Century’ and has used the North American correspondence in the Archive for his research.

The Barings Archive has been engaging in digitisation to make priority areas of the archive more accessible to researchers and the general public all over the world. The Archives give rich insights into the truly global nature of Barings business operations and their contribution towards global financial capitalism.

References:

Buchnea, E., & Elsahn, Z. (2022). Historical social network analysis: Advancing new directions for international business research. International Business Review, 101990.

Orbell, J. (2000). The historical archives of ING Barings. Financial History Review, 7(1), 89-104.

Vedoveli, P. (2018). Information brokers and the making of the Baring crisis, 1857–1890. Financial History Review, 25(3), 357-386.